Adidas vs Puma: A legacy of Rivalry Shaping the Global Fashion and Sportswear Market

Written by: Jason Kusnadi

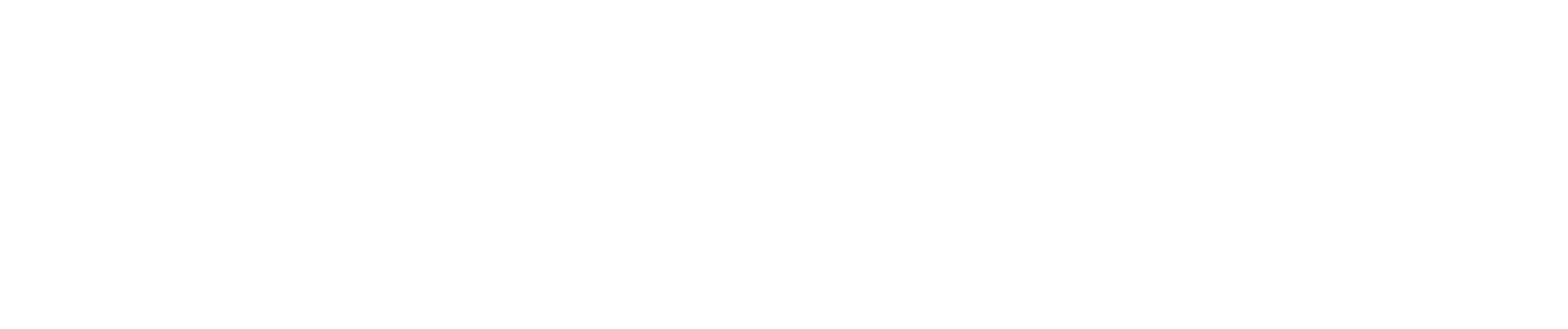

(L – R) Rudolf Dassler, the older brother, founder of the sportswear brand ‘Puma,’ and Adolf “Adi” Dassler – founder of sportswear brand ‘Adidas’. (Image Credit: steadyfoot.com)

Adidas and Puma, two titans of the global sportswear industry, share a storied history rooted in profound family rivalry. The Dassler brothers — Adolf (Adi) and Rudolf (Rudi) —has shaped their respective brands and the sportswear market for decades, each reaching their brand to achieve stardom. Their rivalry persists today, as are both. companies Continue to innovate and vie for market share through strategic endorsements and marketing.

Tensions didn’t always seem to be grim, as the Dassler Brothers originally started a company together back in 1924, creatively named, ‘Gebrüder Dassler Schuh Fabrik’ (Dassler Brothers Shoe Factory), in Herzogenaurach, Germany. Seeing success in the highly famed 1936 Olympics, where the gold-winning Olympian Jesse Owens adorned the Dassler Brothers’ shoes; resulting in explosive demand and increase in sales for the company. However, tragedy struck after World War II, when personal conflicts led to a split between the Dassler brothers. Where the older brother, Rudi, made the brand ‘Puma.’ Whilst the younger brother, Adi, made ‘Adidas.’

Going back to the present day, it is clear which one has made a more significant impact on the market than the other sibling; as of 2020, Adidas leads the market with revenues nearing €20 billion, while Puma’s revenue stands at approximately €5 billion (BBC., n.d.) This begs the question; how did such a huge revenue gap appear over a generation from what seemed like an equal start? Although both brands have secured lucrative endorsements; Adidas boasts partnerships with high-profile athletes like Lionel Messi and Beyoncé, whereas Puma has aligned itself with stars such as Rihanna and Neymar Jr. There are plenty of other aspects that determine the fate of these two titans.

Line graph displaying total revenues earned per annum from year 2002 until 2022 of the brands Nike, Adidas, Puma, and Under Armour (Source and Image Credit: sportsvalue.com)

Having realized revenues of about $23.6 billion (about $73 per person in the US) by December 2022 (statista.com, 2023), Adidas was considerably ahead of Puma, which raked in $8.9 billion (about $27 per person in the US) by the same time (statista.com, 2023). This can be explained by having a wider distribution channel and better brand name recognition worldwide. Nevertheless, through the independent analysis of the situation I have mentioned above, it is possible to state that Puma has reached 28% revenue growth in 2022 (sports value.com, 2023), which proves its capacity to grow in the conditions of rather high competition. As with any brand on the market, economic factors defining the relationship between these two brands are indicative of the tendencies in the sphere. COVID-19 brought significant threats to both competitors: Adidas decreased its revenues by €3.06 billion in the store closures (techround.com, 2020) which had an impact on the companies; in early 2020; Puma, on the other hand, reported a loss of €415 million (techround.com, 2020) at a similar time. Nevertheless, the post-pandemic apparel industry witnessed Adidas coming back on track with its sound e-commerce services and right product portfolio diversification, on the other hand, Puma highlighted digitalization strategies and attracting the young generation.

In conclusion, Adidas is still in a stronger financial position than Puma, though no one can predict what might happen shortly; whether a shift in trend or Puma making a strong and hyped collaboration. Adidas seems to have attempted this well through brand associations and strategic partnerships while Puma has also positioned it well for future growth in emerging markets. This long-standing competition between these two leaders of sportswear companies not only makes innovations but also leads the market of sportswear companies around the world.