E-Commerce Boom: How Indonesia is Leading Southeast Asia’s Digital Market

Written By: Jason Kusnadi

How Indonesia is Leading Southeast Asia’s Digital Market?

William Tanuwijaya, the founder of the leading Indonesian e-commerce company Tokopedia, gave a speech at the World Economic Forum. (Image Credit: World Economic Forum/ Flickr)

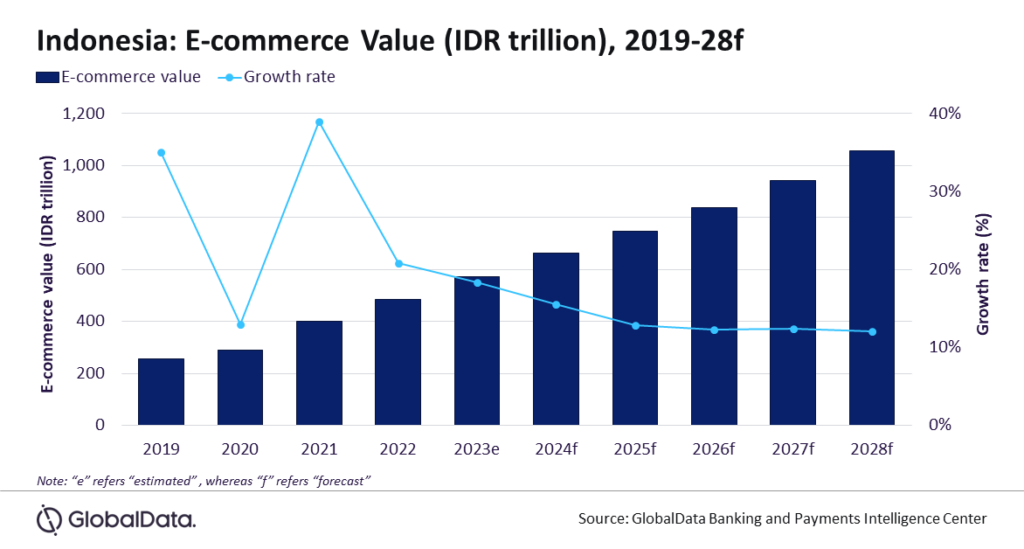

By 2023, Indonesia’s e-commerce market has revealed an astonishing 18.3% growth to reach IDR573 trillion (USS 37.6 billion) (Digitransformation.com, 2024). The market is predicted to increase by 15.5% to reach IDR661.9 trillion (US$ 43.4 billion) in 2024 (Global UK Ltd, 2024). Furthermore, being regarded as one of the top 20 largest economies in the world, Indonesia holds the future of the e-commerce markets in high regard, displaying a projection of reaching $133 billion by 2025 and hitting $360 billion by 2030 (Digitransformation.com, 2024).

Global Data, a global statistics company, suggests that the factors driving this growth directly correlate to the rising internet penetration and increasing disposable incomes. As such, the Indonesian E-Commerce Association (idEA) organizes National Online Shopping Day (Harbolnas) every year in December. Amounting to an Increase in sales in 2023, sales from the Harbolnas event increased by 13% year-on-year to reach IDR25.7 trillion ($1.7 billion) (Global UK Ltd, 2024).

The chart shows the increasing e-commerce value and growth rate of the e-commerce market in Indonesia from 2019 and forecasted/ estimated results up until 2028. (Image Credit: Global Data Banking and Payments Intelligence Center).

Especially with the ever-so-changing consumer preferences, shifting from offline to online shopping, particularly among younger demographics such as Gen Z and millennials. With alternative payment methods, which lead e-commerce space with a combined market share of 42.4% in 2023, according to the Global Data’s 2023 Financial Services Consumer Survey (Global UK Ltd, 2023). Corporations such as OVO, Go Pay, and Dana are some popular alternative payment tools, for both online and offline shopping; removing the need to always bring cash everywhere you go.

But of course, some old habits die hard, especially when not all places accept QRIS, or mobile banking transfer (mBCA, Go Pay, or Shopee Pay). Adding on the fact that as the e-commerce market invites more investors and market demand, the overall competitiveness of firms in the market will increase.

Whether price-elastic or inelastic, all e-commerce firms would have to adapt and compete for higher market share, such that consumer services and experiences will gradually have higher standards, which in turn makes it harder for startups to enter the e-commerce market.

The outlook for Indonesia’s e- commerce sector is exceptionally promising, with projections indicating substantial growth over the next decade. According to Trade Minister Muhammad Lutfi, the value of Indonesia’s digital economy is expected to increase eightfold by 2030, reaching approximately IDR 4,531 trillion (USD 321 billion) from IDR 632 trillion (USD 45 billion) in 2020 (setkab.id, 2021).

E-commerce alone is anticipated to capture a significant share, growing by 34% to reach around IDR 1,900 trillion (USD 136 billion) by the same year (market research.com, 2024).

This growth is fueled by factors such as rising internet penetration, a young and tech-savvy population, and increasing smartphone usage, which positions Indonesia as the largest digital market in Southeast Asia with one of the fastest growth rates in the region.

Additionally, with the introduction of advanced technologies like 5G, artificial intelligence (AI), and blockchain, the digital landscape is set to transform further, enhancing logistics and consumer experiences. However, to fully realize this potential, improvements in telecommunications infrastructure and consumer protection are essential to ensure sustainable growth in this burgeoning sector.

In summary, Indonesia’s e-commerce sector is set for significant growth, reinforcing its status as a leader in Southeast Asia’s digital market. With the increasing use of the internet in Indonesia, a young and tech-obsessed consumer base, and supportive government initiatives; in addition to the convenient and ever-so-popular use of mobile banking and QRIS for both online and offline shopping, the market will surely continue to grow in the next upcoming years.